How to get the latest deal on your own boat finance

Although it can be done to go it alone and directly approach creditors, finding an agent who specializes in boat finance can remove a lot of frustration from the procedure. A broker will need a note of your specifics and liaise with their panel of loan providers to get the deal suitable to your needs. An established broker will also support with controlling the paperwork, expediting the acceptance and assisting you to get the money you will need quickly and effectively. Thus check out following things to see to have the best option:

Get pre-approval:

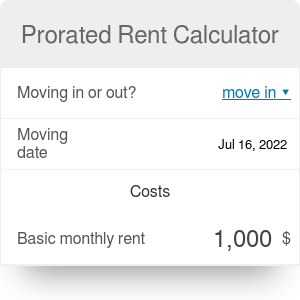

Although it is tempting to start out boat shopping immediately, this is a much better idea to get pre-approval on your own used boat financing. This will enable you to have a company figure at the heart of everything you can spend, removing the disappointment of discovering that the boat you possess set your brain on is not affordable. Additionally, because you have pre-approval, you may well be in a position to negotiate a straight better deal when you are not counting on dealership finance to safe and sound to the sale. Visit www.calculator.academy to have the best finance calculator.

Compare interest levels to get the best deal:

An excellent broker will give you a variety of deals to compare. This implies that you can assess the rates of interest to determine that your most attractive bundle is. Of training, the interest rate ought to be assessed in account to the mortgage term and whether it’s secured or unsecured. Preferably, you should review like for like bargains for a good assessment. It is worthy of checking the every month repayment and total bank loan cost to make certain that your evaluation is exact and you select the most favorable deal.

Check for covered charges or costs:

some lenders apply invisible charges or costs with their loan accounts. This may include processing fees, set up charges and early on repayment fees. These service fees and charges can drastically raise the actual price of your boat financing. For instance, if there is definitely an early on repayment charge predicated on a share of the outstanding stability, this may add up to a huge selection of us dollars. The broker should give a written file which details the keywords and types of conditions including any costs or charges, so be certain to learn through this effectively to make certain that you are thrilled before you consent to the loan.

Balance regular monthly repayment and mortgage term:

although it’s likely you’ll want to pay less than possible every month for your loan, a cheaper regular cost is often accompanied by an extended loan term. This signifies that you will finish up paying considerably more in interest costs over the entire term of the bank loan. To get the perfect deal, you must balance the short-term gain of lower obligations with the ongoing prospects of paying further. You might find that spending five or ten us dollars more every month can possess a dramatic influence on the full total cost of the mortgage.